ITC will be available when motor vehicles are used in the business of supplying cars. A list of No Input Tax Credit.

Why Itc Not Available On Promotional Products Distributed Foc For Sales Promotion A2z Taxcorp Llp

Government intention behind taking the above-mentioned steps whether restricting the quantum of input tax credit by rule 364 or claim of the input tax credit on the basis of GSTR 2A by insertion of new clause aa under section 16 is to curb the practice of claim of the input tax credit through fake invoices which is highly appreciated and really the need of the hour.

. A brief list where input tax credit under GST is not available Section 175 There are some cases where there is no input available under GST to the applicant and there are some exceptions to this hence to know more about this please read carefully the whole article. And amount of ineligibleblocked Input Tax Credit and reversal thereof in return in. GST Network on Tuesday said it has blocked Rs 14000 crore worth of input tax credit ITC of 66000 businesses registered under GST.

Input tax claims are disallowed under Regulation 26 of the GST General Regulations. You can claim the input tax incurred when you satisfy all of the conditions for making such a claim. Ineligible Input tax credit under GST.

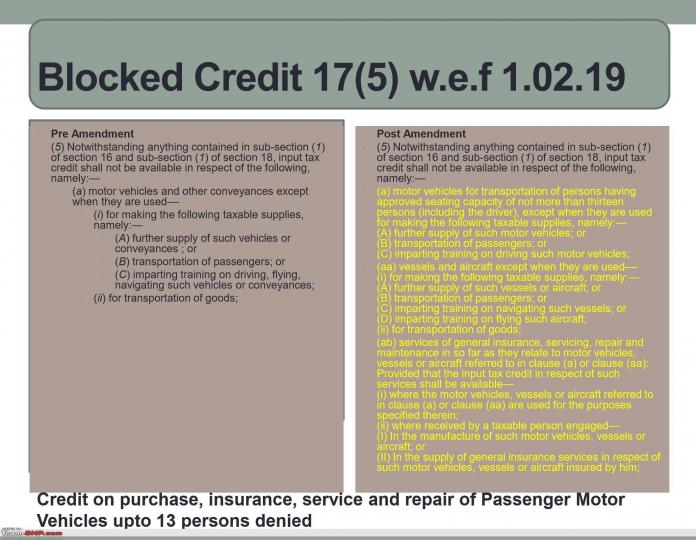

Who Is Eligible for Blocked Input Tax Credit. In the above provision input tax credit for motor vehicles and conveyance has been blocked unless motor vehicle has been purchased to further supply or for transportation of passenger or motor vehicle has been purchased for imparting training. CBIC-2000122022-GST Government of India.

When registered taxpayer will not be entitled to claim tax credit is discussed in this article. GST has been introduced in India with an objective of providing free flow of taxes and eliminating cascading double taxation effect in various indirect taxes and simplifying the tax structure. The input tax Purchase is 300.

The goodsservices in question have been delivered. The dealer must have a tax invoice on hand. 1 Where the goods or services or both are used by the registered person partly for the purpose of any business and partly for other purposes the amount of credit shall be restricted to so much of the input tax as is attributable to the purposes of his business.

Input tax claims are allowed subject to the conditions for input tax claim. The GST law has specific cases where no Input Tax Credit or ITC can be claimed or is available to the taxpayer. Input Tax Credit ITC is the one of the most important reasons for introducing GST.

The registered person is eligible to claim input tax on the GST that has been incurred. A bedding manufacturer who is a GST registered person bought beds and oil paintings worth RM5000 for use in the showroom of the plant. Section 17 of CGST Act 2017 contains provisions related to Apportionment of credit and blocked credits or where inputs tax credit are not available for utilisation ie.

You should only claim input tax in the accounting period corresponding to the date of the invoice or import permit. With effect from December 2020 FORM GSTR-3B is getting auto-generated on the portal by way of auto-population of input tax credit ITC from FORM GSTR-2B auto. A person who is registered for GST can only claim the input tax credit if he meets all of the requirements.

Responding to social media posts based on an RTI reply about the Rs 614 lakh crore of ITC blocked under Rule 86A of GST laws GSTN tweeted that the figure includes erroneous data entries made by the taxpayers. Input Tax Credit is blocked on the Motor Vehicles and conveyances but there are certain exceptions as to this rule which are as mentioned below-a. He is eligible to claim input tax of RM200 RM5000 x 4 since the beds and oil.

Denial of refund on Input Services under Inverted Duty Structure Scheme Various Issues under Refund IGST vs. Considering the fact that Goods and Service Tax GST is a tax based on value addition only Input Tax credit ITC is a fundamental concept for such purpose. Blocked input tax however means input tax credit that business cannot claim.

Family benefits for staff. ITEMS ON WHICH CREDIT IS NOT ALLOWED IN GST. Motor Vehicle and other conveyance Vessel and Aircraft.

You can claim a 300 in your credit and have to pay 150 in taxes. Mandatory furnishing of correct and proper information of inter-State supplies and amount of ineligibleblocked Input Tax Credit and reversal thereof in return in FORM GSTR-3B and statement in FORM GSTR-1. 14 Blocked Input Tax Credit ITC under GST.

170022022-GST Page 1 of 7 FNo. Cases where Input Tax Credit under GST cannot be availed- Blocked credit under GST. 2 Where the goods or services or both are used.

Green fees buggy fees rental of golf bag locker and dining at club restaurants. GST Input Tax Credit Relevance of GSTR 2A 2B Scrutiny Notices Blocked ITC in GST Cascading of Taxes. GST Input Tax Credit on Restaurants and Hotel Accommodation.

Expenses for use of club facilities Eg. GST CIRCULAR 170022022 GST. However input can also be claimed for transportation of goods.

These are called blocked credit. Motor Vehicles and Conveyances. Supply or importation of passenger car including lease of passenger car Passenger car is defined as a motor car of a kind normally used on public roads which is constructed or adapted for the carriage of not more than nine passengers inclusive of the.

When purchasing from GST-registered suppliers or importing goods into Singapore you may have incurred GST input tax. The GST section 175 describes the circumstances when such block credit s are ineligible and the special conditions when they become eligible to avail ITCs. GST - Mandatory furnishing of correct and proper information of.

According to me the Input Tax Credit ITC can only be availed if you are fulfilling all the conditions of Section 16 2 but its sad to say that many taxpayers are also taking credit for goods which are falling under Block Credit for example they are taking credit of car lift etc and also states there Advocates CA Practitioners to take the credit and theyll handle themselves. GST Mandatory furnishing of correct and proper information of inter-State supplies and amount of ineligibleblocked Input Tax Credit and reversal thereof in return in FORM GSTR-3B and statement in FORM GSTR-1 - CGST - Circular. Input Tax Credit ITC of the tax paid on almost all taxable supply of goods or services or both used in the course or furtherance of business is allowed under GST except the list of supply provided in Section 17 5 of CGST Act 2017.

These are called blocked credit.

Ineligible Itc Under Gst Complete List With Example

Input Tax Credit And Its Nuances Under The Gst Law Novello Advisors

Industry Seeks Gst Refund On Interest Paid For Blocked Ineligible Itc Goods And Service Tax Goods And Services Tax Credits

No More Input Tax Credit On Automotive Invoices Team Bhp

Eligibility Conditions For Taking Input Tax Credit Under Gst By Sn Panigrahi Youtube

Gst Input Tax Credit Blocked Credits Taxmann

No More Input Tax Credit On Automotive Invoices Team Bhp

Can A Tax Officer Block My Cash Or Credit Ledger In Gst Quora

Cbic Asks Gst Officers To Block Itc Only On Basis Of Evidence Not Suspicion The Financial Express

Apportionment Of Credit And Blocked Credit Under Gst

Expenses For Which You Cannot Claim Itc Credit Under Gst

When Gst Input Tax Credit Will Be Blocked From Electronic Credit Ledger Youtube

Ineligible Input Tax Credit Under Gst U S 17 5 Youtube

An Overview Of Blocked Itc Under Gst Corpbiz Advisors

Is Blocking Of Itc By The Gst Department Legal Rule 86a Enterslice

Overview On Input Tax Credit Under Gst Law Passed On 27th March 2017

Gst Gujarat High Court Issues Notices To Central State Over Blocking Of Itc Under Rule 86a

Restrictions On Input Tax Credit Us 17 5 Under Gst Blocked Credits Under Gst Youtube

Input Tax Credit Under Gst Goods And Service Tax Simple Tax India